Launch into the Aerospace Market in the Southeastern United States – update # 3

The Global Market Forecast and the new Chief Commercial Officer, Eric Schulz, Chief Commercial Officer by Airbus anticipates 37,400 new deliveries over the next 20 years with a current fleet of 21,500!

The value of it …$5.8 Trillion aircraft value!

10,600 aircraft will stay in service from these days.

Interesting to know that 54% ($3.2 Tn) in value is expected from small body i.e. 230 seats and 3,000 nm range and 25% ($1.4 Tn) from medium body i.e. 300 seats and 5,000 nm range.

Also, a growth of 10% ($0.6 Tn) in large body and 11% ($0.6 Tn) in XL categories are expected as well.

Backlog market shares of Airbus is 88% in medium body (A321 LR and A330 neo), 54% in smaller airplane (single-aisle plane). For larger plane, the backlog is 52% for L – A 350 XWB and 35% for the XL segment (A 380, A350-1000).

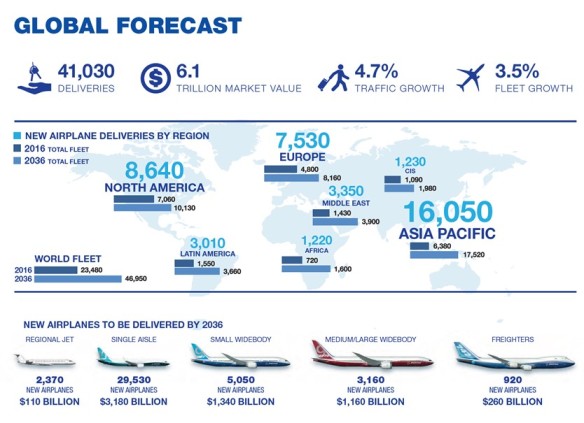

Like its peer, Boeing Current Market Outlook (CMO) is dedicated to forecasting new airplane demand over the next 20 years. In many ways, it paints a picture of the future of flight.

Although the numbers do not match the analysis of the trends is the same.

Based on the CMO from Boeing, it anticipates 41,030 deliveries over the next 20 years with a current fleet of 21,500!

The value of it …$6.1Trillion aircraft value!

3,070 additional planes will be flying over the US to reach 10,130 planes in active duty.

In a nutshell see the executive summary of this Market Outlook as below:

Do you want a “piece of the Business”? Question is more …how, right? Then, let’s check below first…

Florida’s NASA rocket ships aren’t the only ones in the Southeast lifting off at high speeds. The aerospace industry is the fastest growing industry in the region. Georgia, Alabama, Florida, Mississippi, North Carolina, South Carolina and Tennessee have collectively become an industry leader, with major firms setting up manufacturing sites all throughout the area.

See the map prepared by The Georgia Electric Membership Corporation below:

Foreign firms are attracted to the U.S. aerospace market because it is the largest in the world and has a skilled and hospitable workforce, extensive distribution systems, diverse offerings, and strong support at the local and national level for policy and promotion. According to a study by the U.S. Department of Commerce, aerospace exports directly and indirectly support more jobs than the export of any other commodity. Investment in the U.S. aerospace industry is facilitated by a large pool of well-trained machinists, aerospace engineers, and other highly skilled workers with experience in the aerospace industry.

The graphic on the right below illustrates how aerospace exports in the Southeast have been outpacing overall U.S. aerospace exports, increasing by 180 percent from 2006 to 2016, 2.3 times the growth of U.S. exports. Georgia has been substantially overtaking both the Southeast and U.S. overall. Georgia’s aerospace industry exports account for 30 percent of all aerospace exports in the Southeast, followed by Florida with 25.9 percent and South Carolina with 24.7 percent.

Georgia Aerospace economic impact has been estimated at $63.8B by the Georgia Economic Development ,12% increase over 2013. 99,000 highly skilled workers are employed by 800 + Companies.

Investors in the U.S. aerospace industry are supported by the Federal Aviation Administration’s (FAA) “gold standard” of aviation safety, boosting the confidence worldwide in the safety of aircraft and aircraft parts manufactured in the United States.

State Specialties

Each state has its own special advantages and contributions that strengthen the industry:

- Georgia: According to PWC, Georgia ranks #1 overall for aerospace manufacturing attractiveness. Georgia houses more than 800 companies in the aerospace industry, along with a business climate consistently ranked as one of the best in the country with a business-friendly tax code and other incentives. Aircraft manufacturing accounts for more than 70 percent of all employment in Georgia’s aerospace industry, followed by other air transportation support activities and aircraft engine and engine parts manufacturing with 12.2 percent and 9.2 percent, respectively.

- Florida ranks #2 among states for aviation and aerospace establishments, with more than 2,000 companies employing 82,500 workers. These businesses export more than $5.2 billion in goods annually, making Florida a national leader in these sectors.

- North Carolina is now second in the U.S. in aerospace growth, and hosts two of the top 10 aerospace and aviation clusters in the South. The state justifies such growth due to unique industry research advantages, 9,500+ aerospace manufacturing employees, cost advantages, and more.

- Mississippi is home to some of the world’s most renowned names in aerospace: GE Aviation, Airbus Helicopters, Rolls-Royce and Lockheed Martin. All rely on a skilled and productive workforce, comprehensive workforce training, a supportive business environment, a strategic location, low startup and operation costs, and cutting-edge R&D.

- Over 300 aerospace companies from more than 30 different countries have chosen Alabama, including industry giants such as Boeing, Lockheed Martin, GE Aviation, Raytheon and GKN Aerospace. Another of these giants is Airbus, which now produces its A320 Family passenger jets at a new $600 million manufacturing facility in Mobile.

- Some of the world’s top aerospace and defense companies operate facilities in Tennessee, including Vought Industries, Beretta USA, Eaton Corp., Standard Aero Alliance, Honeywell, Barrett Firearms Manufacturing, BAE Systems Ordinance and Bell Helicopters, with more on the way.

- The total economic impact of aerospace on South Carolina’s economy is $19 billion per year. There are approximately 400 aerospace companies in South Carolina and four aviation related military facilities. These companies and facilities combined employ more than 53,000 people. Of the 17,000 employed in the private sector, approximately 72.2 percent of employees are in manufacturing, 17.8 percent of employees are in air transportation support, and 10 percent are in air transportation.

Ideal Business Environment

Many factors are guiding aerospace firms towards the Southeast:

- Strong economy – the Southeast is one of the nation’s most robust economies, with a GDP of $3.8 trillion in 2015, which represents nearly 21 percent of the U.S. economy as a whole

- Growing workforce – the region accounted for 17.9% of all U.S. workers in 2012

- Growing population – population growth in the Southeast outpaces that of the U.S. overall due to the excellent weather and economic climate, and is currently home to 25.75% of the U.S. population

- Well-educated population – the Southeast has some of the nation’s top colleges and universities

- Low unionization – unionization rates in the Southeast are low and continue to decline

- Low cost of doing business – for major cost measures, most Southeastern states are below the national average

Proximity to numerous space launch facilities in the Southeast helps aerospace firms lower the cost of doing business in logistics, manufacturing and R&D, while positioning them to capitalize on the emerging space market.

The Southeast can present a lucrative opportunity for any aeronautical company looking to invest. But given your company’s particular needs, what would be the ideal market entry strategy? Mergers and acquisitions? Setting up a U.S.-based sales office? Finding a partner to penetrate the market? Direct sales?

Each heterogeneous region of the United States presents its own unique advantages and challenges. Foreign firms need a partner – an expert hands-on in the region’s aerospace business environment – who they can count on. Proper planning and a well-researched approach can put companies on the right flight path for growth and profitability. And passion!

Please contact COGNEGY with any questions you might have: phil.jafflin@cognegy.com